Engulfing Candlestick Pattern

Engulfing Candlestick Pattern Definition. How to trade?

Candlestick patterns are much more clear and powerful indicators. Use for predicting approximate results in the stock market, forex, etc.

Candlestick patterns pattern represents the price fluctuation for a given period of time. This pattern uses two-color, red and green, to represent the market’s strong selling and buying day. With the Candlestick chart, you can guess the next probable move of the stock market. In this post, we’ll cover up everything you need to know about Candlestick patterns.

What is a Candlestick?

A candlestick is a chart where displays information about stock price movement. Candlestick chart makes easy of technical analysis and enables the interpretation of price movement.

The Candlestick chart has lots of indicators that will help to guess the next movement of the market. Candlestick chart requires body, wick, and color to make trading more specific. Each of the candlestick parts contains a certain amount of information.

This post will tell you everything about candlestick charts and patterns that will help you understand more precisely.

Basics of a Candlestick

As a new trader in the stock market, forex, or any other platform, you might be having trouble with some technical terms of the Candlestick pattern. It’s okay to confuse at the very first phase. Here we are going to explain from the very beginning. So, let’s move in.

First thing first, you need to understand Bullish Candle and Bearish candle.

Bullish Candle: A Bullish candle, a green or white candle, represent a price hike for a certain amount of time. It informs traders that the stock going on an uptrend.

Bearish Candle: A bearish Candle, a red or black candle, depicts the price getting lower or decreasing at that time.

Candlestick’s timeframe starts from 5 minutes. The timeframe is important because the chart will show you for that specific time stocks ups and downs. So it can be five minutes to one hour, one day, one week, and so on.

The rectangular part of candlesticks is considered as a ‘real body’ for both red and green colors. The real body is representative of the opening and closing price.

In Bullish candle, the top of the body of candlesticks is called closing price, and the bottom is considered as opening price.

But bearish candle closing price and opening price is just opposite of bullish candle.

Where the top of the bearish candle represents an opening price and the bottom is a closing price.

In the chart, you will find a black stick called wick, representing an intra-day high and low price fluctuation. Now it’s time to look for candlestick patterns.

How many are candlestick patterns?

There are lots of candlestick patterns detected. A rough estimate is around 100 plus candlesticks patterns exist.

Stock market fluctuation creates lots of patterns that most of are unknown. This article will cover up 10 candlesticks patterns that will help you understand the market fluctuation. If you understand it properly, you will be able to guess the next probable move.

Most popular 10 Types of Candlestick Patterns:

Hammer:

Hammer pattern is the easiest candlestick pattern and easy to trade by anyone. You will see this pattern at the bottom of a trend.

This pattern implies that no other seller is going to sell it. So now buyers can come in to bring the price higher.

When sellers are no more to bring down the price and became exhausted, that’s the moment to create space for buyers. From this pattern, buyers get an extra advantage to make the trade.

The bottom of the pattern will seem like a hammer. That is the reason to make this pattern name hammer patter.

The Hammer pattern doesn’t follow color rules. Any of the colors make this type of change. Longer wick creates pressure to buy, which means after a long wick, the market will see the biggest difference for a certain amount of time.

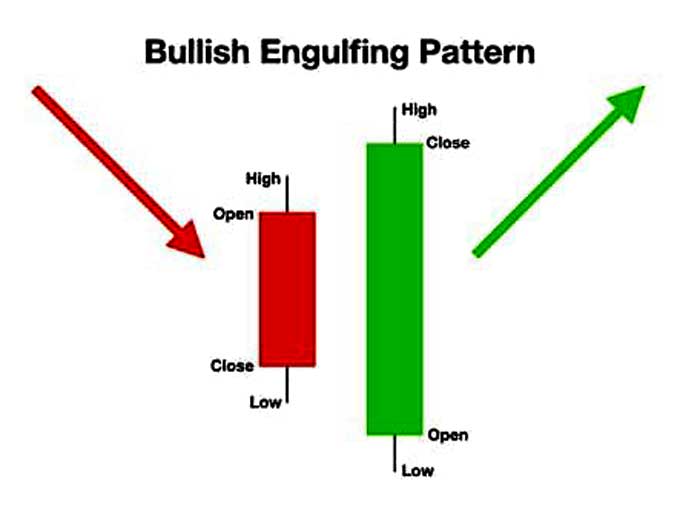

Bullish Engulfing:

When the seller became week, a buyer comes into the market and engulfs the small red candle.

Doji:

Bullish engulfing crate between two candlesticks. Red small candlestick completely engulfed by a larger green candle.

When the market is confused, that situation creates a Doji pattern. In short, if opening and closing points remain at the same points, that would be called the Doji pattern.

The situation is something like that when buyer and seller are became confused with trading. Because there is no biggest fluctuation appears. You can call the Doji pattern is a neutral pattern.

Bullish Harami:

Bullish Harami happens when lots of buyers enter. Though this pattern appears quite frequently but you can find it during trend. If you find this pattern at the bottom of a downtrend, you have a higher chance of success.

The previous candlestick of the Bullish Harami pattern is bigger than the next candlesticks. Therefore, bullish Harami patterns exist within its previous candle’s high, open, close, and low range.

Morning Star:

The morning star is one of the most favorite candlestick patterns among all. This pattern creates hopes in a downtrend market.

This exists between the long red candle and a long green candle. This pattern indicates the next potential spike of trend.

Evening Star:

This pattern indicates the reversal of uptrend that we have seen in a morning star pattern—this pattern you will find this pattern between two long green and red candles.

Inverse hammer:

When upper wick is long and the market goes uptrend, that time it seems like an inverted hammer. That is why this pattern is called inverse hammer pattern. When seller became weak, and buyer became strong at this point. Inverse hammer indicates that now it’s time to move on buyers.

Shooting Star:

The shooting star pattern is just opposite direction of inverse hammer. So shooting star pattern also seems like a hammer, but the hammer wick remains on top of the candle. But it follows the downtrend. So after a couple of green candles, then you can see shooting stars, and the market goes down.

Three black crows:

The three black crow’s candlestick pattern appears as three long red candles where you barely find wicks. The main characteristic of this pattern is each session starts from the previous day. This pattern pushes the market down.

Three white soldier:

The three white soldiers’ patterns are almost opposite of three black crows where you can see the same limited wick, but the main distinctive part is that the candle is green and the potential direction of the market is an uptrend. Where buyers gets advantages. After three consecutive green candles and one red candle, and again green candle makes market uptrend.

Except these 10 candlesticks patterns, there are exist numerous patterns appear in the market. Traders use candlesticks charts over a long period of time cause this chart is much more specific.